Unemployment Tax Refund Timeline

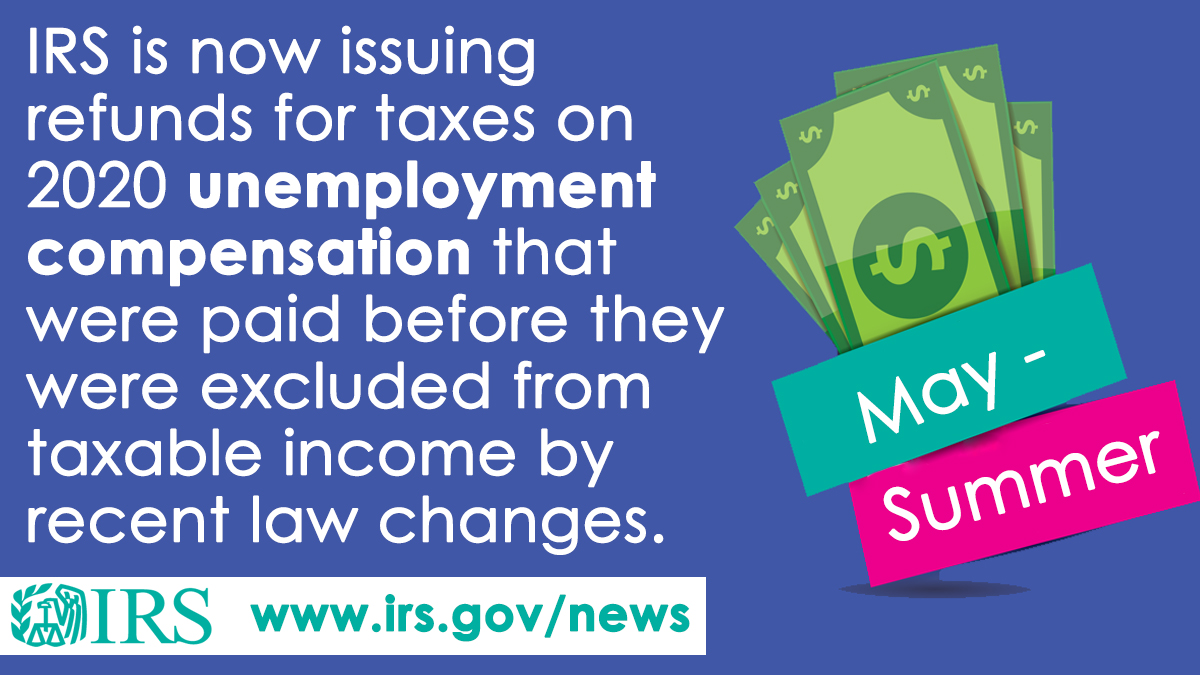

All summer long the IRS has been distributing additional refund payments to taxpayers who overpaid on 2020 unemployment. 15 million unemployment refunds are coming.

The Roman Republic Fails Ancient Rome For Kids Ancient Rome Kids Roman Republic Ancient Rome

For the most part taxpayers eligible for these refunds do not need to file an adjusted tax return.

Unemployment tax refund timeline. Payment schedule transcripts and more. Simple to complicated individuals to businesses we can handle it. The IRS says it will send 2020 unemployment refunds through.

Most taxpayers dont need to file an amended return to. Angela LangCNET Weeks ago the IRS sent out an initial batch of 28 million refund checks to Americans who paid income tax on jobless benefits collected in 2020. The average IRS refund for taxpayers who paid too much tax on unemployment compensation is 1265.

Although it hasnt officially announced a date for the latest batch of these payments yet a number of people posted on social media forums last week that their tax transcript had been updated with a date of August 18 which is today. Not everybody will obtain a refund. IRS unemployment tax refund status.

The Internal Revenue Service has said refund checks related to unemployment compensation would continue through the summer. The Internal Revenue Service has said refund checks related to unemployment compensation would continue through the summer. A source familiar with the IRSs timing.

The IRS will continue sending 2020 unemployment refunds through the end of summer. If youre due an adjustment the IRS will send you a letter within 30 days of the correction. The IRS is recalculating taxes on unemployment compensation and sending letters with the amount.

IRS unemployment refund update. What is the timeline for August paymentsIRS unemployment tax refund. If the IRS determines you are owed a refund on the unemployment tax break it will automatically send a check.

Refunds began going out in Could and can exit in batches. The IRS says eligible individuals shouldve received Form 1099-G from their state unemployment agency showing in Box 1 the total unemployment compensation paid in 2020. Locate your tax transcript for your unemployment refund details.

Unemployment refund status. If the IRS determines you might be owed a refund on the unemployment tax break it can routinely appropriate your return and ship a refund with none extra motion out of your finish. IRS timeline tax transcripts and more Published August 5 2021 The IRS has sent more than 87 million unemployment tax refunds.

Simple to complicated individuals to businesses we can handle it. If youre still waiting on your tax refund for unemployment benefits from last year you overpaid on it may arrive sooner than you think. The IRS automatically corrects 2020 returns and sends letters with the amount of the unemployment tax refund.

The American Rescue Plan made the first 10200 of 2020 jobless benefits nontaxable income. The tax agency is sending another batch of refunds to nearly 4 million people. The amount of the refund will vary per person depending on overall income tax bracket and how much earnings came from unemployment benefits.

Refunds started going out the week of May 10 and will run through the summer as the IRS evaluates tax returns. Its last update was in July. The last batch was sent in July totaling 15 million refunds.

IRS payment schedule tax transcripts and more. Its last update was in July. If you still havent received your IRS refund for the taxes you paid on last years unemployment benefits check your bank account and your mailbox.

Its last update was in July. Locate your tax transcript for unemployment refund details. Annonce Were here for you through the tax season and beyond.

The tax agency announced it sent out. In fact that extra IRS money could be in your bank account or your mailbox this week. While some people have reported theyve received IRS updates on their tax transcripts showing pending dates later this month many other taxpayers are still waiting to get their money.

But how exactly does the unemployment refund work. More complicated returns could take longer to process. If you didnt you should request one online Some states may issue separate forms depending on the jobless benefits for example if you received federal pandemic unemployment.

The IRS says eligible individuals shouldve received Form 1099-G from their state unemployment agency showing in Box 1 the total unemployment compensation paid in 2020. The IRS can seize the refund to cowl a past-due debt akin to unpaid federal or state taxes and youngster assist. Msn back to.

Annonce Were here for you through the tax season and beyond. If you didnt you should request one online Some states may issue separate forms depending on the jobless benefits for example if you received federal pandemic unemployment. That means some single taxpayers without dependents shouldve seen refunds.

Direct deposit refunds went out on July.

Irs To Start Sending 10 200 Unemployment Benefit Tax Refunds In May

36 600 Saved With This Weeks Unemployment Check Of 374 My Tax Refund Of 58 30 Was Deposited Landline Phone Tax Refund Phone

Eip Card Stimulus Check Can I Transfer It To My Bank Account Everything You Need To Know How To Get Money Stimulus Check How To Find Out

Pin On Similus Checks Amt When

Irsnews On Twitter Irs Is Issuing Refunds For Taxes Paid On 2020 Unemployment Compensation Excluded From Income The First Adjustments Are For Single Taxpayers Who Had The Simplest Tax Returns Details At

Here S What To Know Now That The Irs Has Stopped Sending Stimulus Checks Stimulus Check Second Stimulus Check Tax Season

Maxine Timeline Photos Facebook Maxine Accounting Humor Taxes Humor

Millions Still In Line For Unemployment Tax Refunds

What You Should Know About Unemployment Tax Refund

Irs Unemployment Tax Refund Status The Latest On Payment Schedule Transcripts And More Cnet

Irs Tax Refund Delays Persist For Months For Some Americans Abc13 Houston

When Will You Get Your 2020 Income Tax Refund

Risk Of Stock Market Loss Over Time 1926 2019 Stock Market Marketing Economy

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Revenue

Irs Reports A Backlog Of 35 Million Unprocessed Tax Returns Khou Com

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Many Minnesotans Will See Automatic Tax Refunds Soon After Legislative Deal

Are Business Loans Taxable As Income Understanding And Interpreting Business Tax Law Is A Daunting Task But Is A Busines Business Loans Income Business Tax

Post a Comment for "Unemployment Tax Refund Timeline"